prince william county real estate tax payments

Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. Enter the Tax Account numbers listed on the billing.

New Hours For Taxpayer Services Call Center And Counter Locations

Occasionally the billing information on file is incorrect and a real estate tax bill that should have been sent to a.

. 1-888-272-9829 enter code 1036. This estimation determines how much youll pay. Manage Access - Grant Revoke.

If you have not received a tax bill for your vehicles contact the. A convenience fee is added to payments by credit or debit card. Click here pay online.

Teléfono 1-800-487-4567 entrando código 1036. Access to Other Accounts. When tax assessors estimate the value of your property they multiply that number by the tax rate of the county.

Search 703 792-6000 TTY. You can pay a bill without logging in using this screen. Press 1 for Personal Property Tax.

Press 2 for Real Estate Tax. Make checks payable to Prince. Learn all about Prince William County real estate tax.

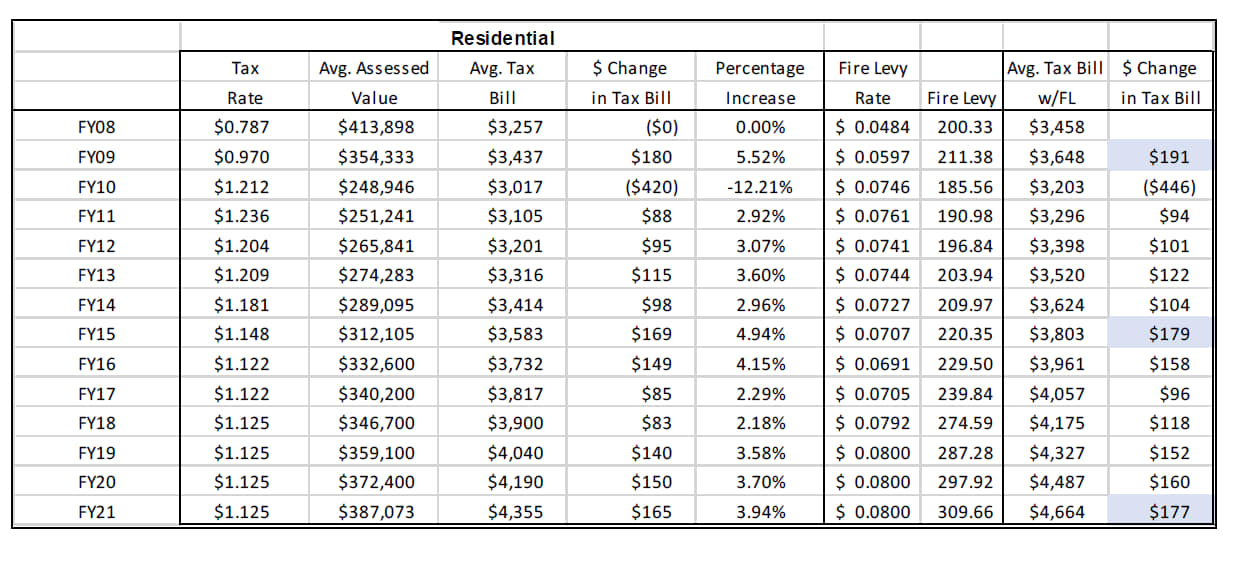

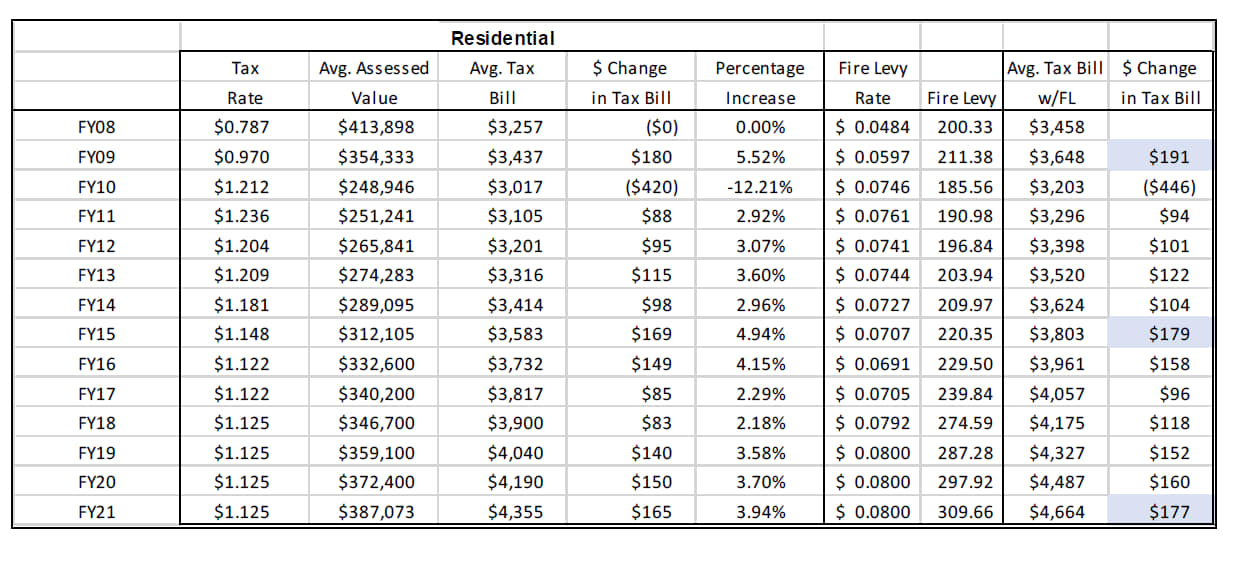

The County bills and collects tax payments directly from these companies. Prince William County Property Tax Payments Annual Prince William County Virginia. Hi the county assesses a land value and an improvements value to get a total value.

If you have not received a tax bill for your vehicles contact the. In Prince William County. Payment by e-check is a free service.

Provide Tax Relief To Individuals and Families Through Convenient Referrals. All you need is your tax account number and your checkbook or credit card. Proceso de pago en espanol.

Property Assessments Real Estate Information. The Prince William County Police Department is requiring all businesses and residents to register their alarm systems with the department. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

Provided by Prince William County Communications Office. Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States. Personal Property Taxes Due October 5 2022 Prince William County Personal Property taxes for 2022 are due on October 5th.

Payment of the Personal. Median Property Taxes Mortgage 3893. Find All The Record Information You Need Here.

Free Case Review Begin Online. How property tax calculated in pwc. Pay Your Property Taxes Online Current Property Tax Information 2022-2023 Tax Bill Update.

Prince William County collects on average 09 of a propertys. Ad See If You Qualify For IRS Fresh Start Program. By creating an account you will have access to balance and account information notifications etc.

Ad Find Prince William County Online Property Tax Bill Info From 2022. Then they get the assessed value by multiplying the. Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local.

July 2 2022. Personal Property Taxes Due October 5 2022 Prince William County Personal Property taxes for 2022 are due on October 5th. Finding the Amount of Property Taxes Paid.

When prompted enter Jurisdiction Code 1036 for Prince William County. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. The Prince William County Department of Finance reminds residents that personal property taxes are due on or before Monday Oct.

Unsure Of The Value Of Your Property. How The Payment Process. Welcome to Prince William Countys Taxpayer Portal.

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Explore Prince William County Parks This Summer With The Pwc Parks Explorer Pass

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

Prince William County Real Estate Taxes Due July 15 2022

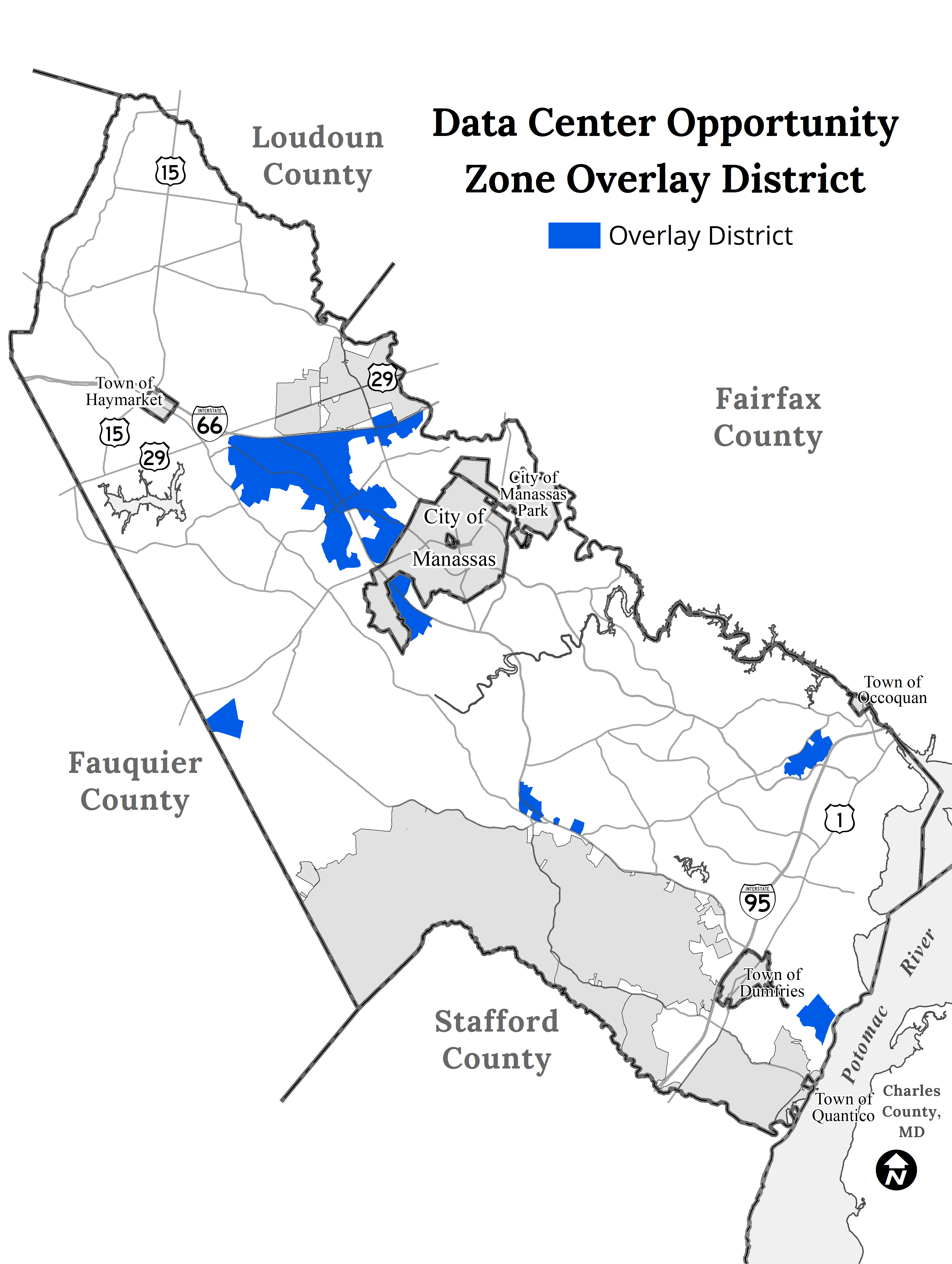

Data Center Opportunity Zone Overlay District Comprehensive Review

Job Opportunities Prince William County

Public Hearing Scheduled For Controversial Pw Digital Gateway Proposal Headlines Insidenova Com

Join Renew Realtor Association Of Prince William

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Prince William County Data Center Site Sells For 74 5 Million Dcd

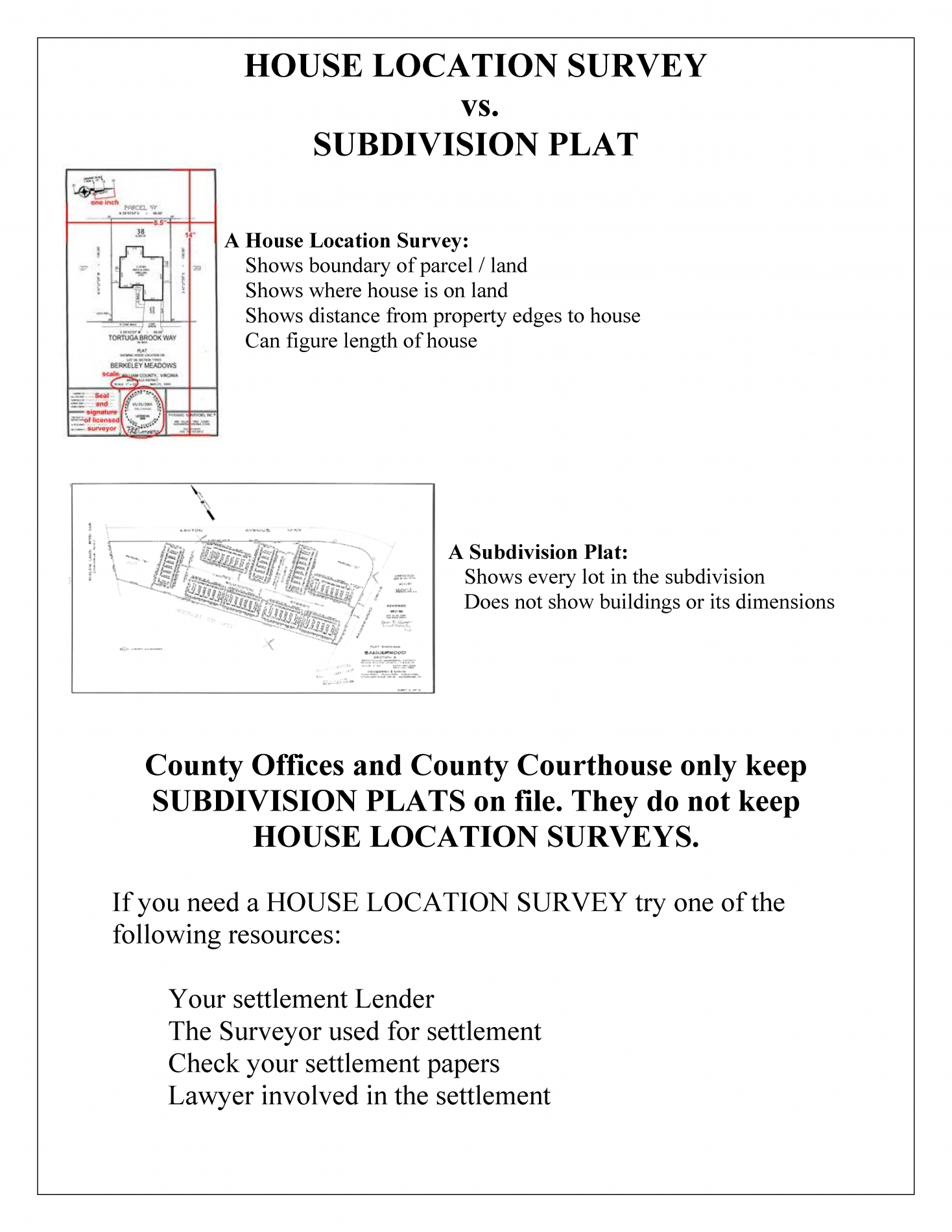

5 Things Agents Need To Know About The Tax Grievance Process Property Tax Grievance Heller Consultants Tax Grievance

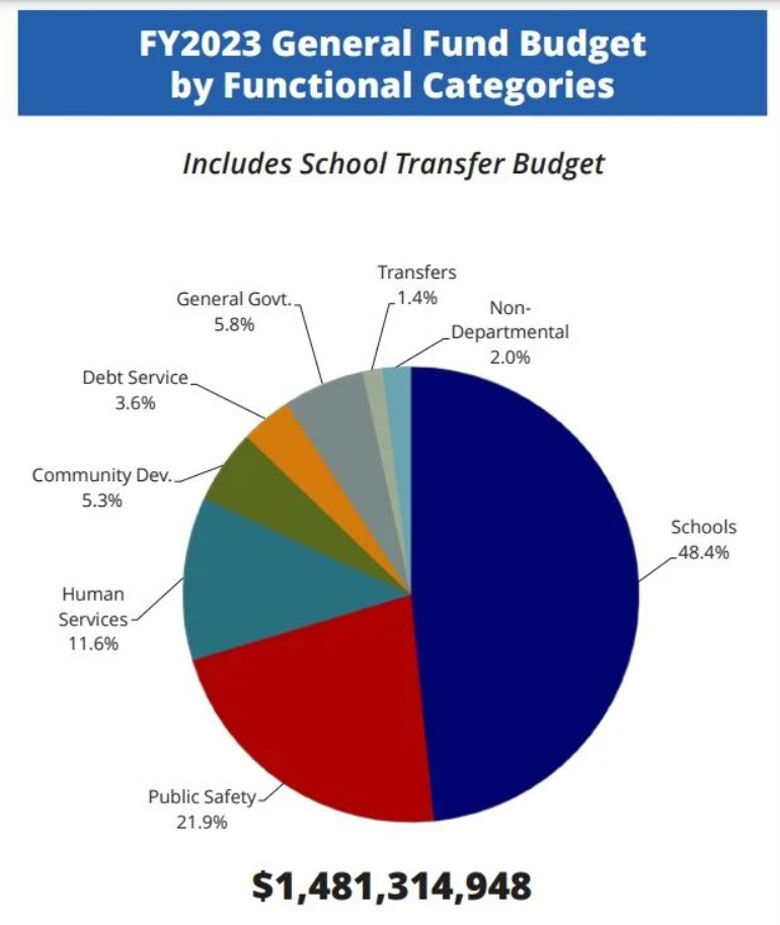

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Prince William County Planning Commission Approves Data Center Between Manassas And Gainesville Headlines Insidenova Com